Merchant One Review

If you’re a small or new business with limited credit, Merchant One’s simplified payment processing system is a great choice. With a 98% approval rating, top-notch customer service, and remarkably simple software, you’ll have no problem getting started.

TOP RATED

Pros & Cons

Pros

- 98% approval rating

- Transaction rates are low

- Free terminals

- Get started in < 24 hours

- Notably easy to use

- Great 24/7 customer service

Cons

- Lack of fee transparency

- Potential termination fees

- Long-term contracts

- No live chat support

Merchant One Overview

Starting and running a small business is no easy feat. Between managing inventory, employees, marketing, and more, you have a lot on your plate already. The last thing you need is to feel overwhelmed by your merchant services provider.

That’s where Merchant One shines. With over 20 years of experience working with businesses like yours, it offers the personalized support and intuitive tools you need to start processing payments.

Plus, getting set up usually takes less than 24 hours so you don’t have to wait days or even weeks to get going.

One of the biggest perks is the lack of red tape—Merchant One’s 98% approval rate means you can get approved, even if you have little or no credit as a new business owner. The company even provides a free credit card terminal to start, so you don’t need to purchase anything up front. Down the road, you can upgrade to high-quality terminals and equipment as needed.

Merchant One keeps costs low with reasonable monthly fees and transaction rates. On top of that, you’ll have access to outstanding 24/7 customer support, thorough onboarding, and integration assistance when you need it.

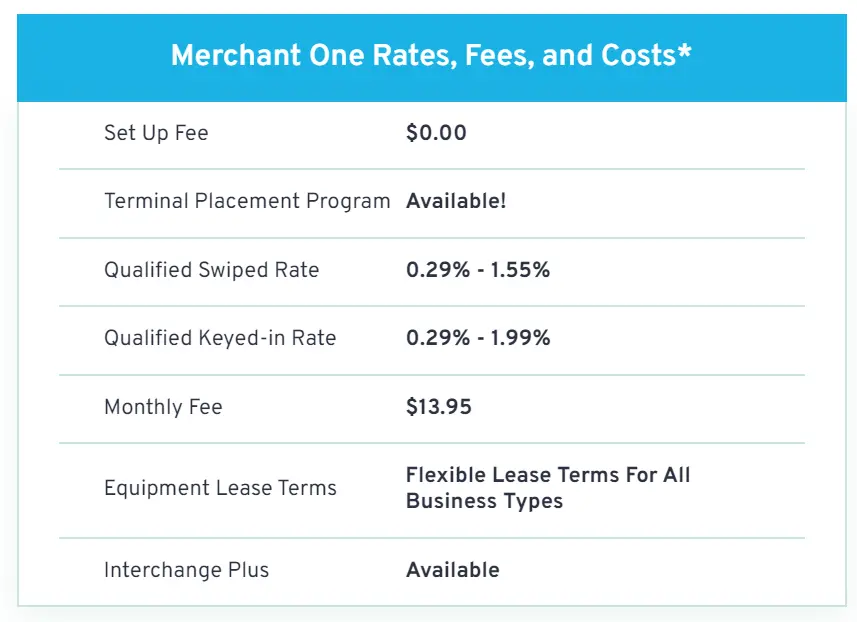

Merchant One Plans and Pricing

Merchant One offers a straightforward monthly fee of $13.95 to use its services. This gives you access to its payment processing capabilities, software, and customer support.

When it comes to per-transaction fees, Merchant One uses a tiered pricing model based on the type of card used. Qualified transactions, typically involving major credit cards like Visa and Mastercard, cost between 0.29% and 1.99% per transaction.

Compared to competitors, these qualified rates are on the lower end, which is great.

However, Merchant One does not disclose its mid-qualified or non-qualified transaction fees. You’ll have to reach out to the company for a customized rate for things like rewards cards, corporate cards, or transactions that don’t require address verification.

Overall, more transparency about these fees (and others) would be nice to see.

We also wish the contract terms, termination fees, and other account fees were more transparent.

If you’re not a fan of the tiered transaction fee structure, Merchant One offers interchange plus pricing, but it’s unclear what the markups are above interchange or how to qualify if you prefer this structure.

Unlike other merchant services, hardware and equipment are not included in the monthly fee. However, new customers get a free terminal and you can purchase or lease terminals, mobile card readers, and full stations at any time.

Payment Options

If you’re just starting out or running a small operation, you want payment processing that won’t overwhelm or overcomplicate things. Merchant One has you covered.

Its mobile and wireless solutions let you transform phones and tablets you already own into full-fledged point-of-sale systems. Simply pair your device with a mobile card reader, and you’ve got everything you need to accept payments on the go. No big, bulky equipment required.

This type of setup is perfect for pop-ups, markets, and all your mobile merchandising needs.

For retail stores or restaurants, Merchant One offers feature-packed systems to manage in-person sales. Accept credit, debit, tap, swipe—you name it. Built-in tools like customer management, loyalty programs, and text marketing help you engage patrons and drive repeat business. Specific features for restaurants even allow for easy tip adjustments, bill splitting, and table management.

Ecommerce more your speed? Merchant One plays nice with popular online store platforms. And its virtual terminals allow you to securely process orders over the phone or by invoice. No matter how you run your business, it’ll make sure you can accept payments with ease.

If you’re not sure what you need, Merchant One’s experts will work closely with you to customize features and avoid unnecessary clutter so you only pay for what you actually use.

Funds typically hit your account in 2-3 days, which is slightly slower than some providers. But Merchant One also offers quicker transfers for an additional fee if you need faster access to processed payments.

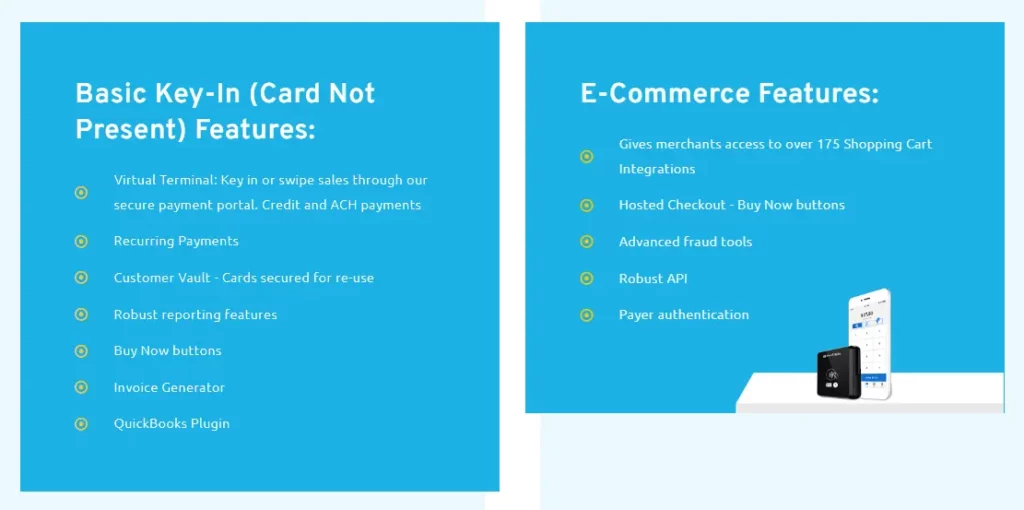

Ecommerce Functionality

Starting an online business? Merchant One offers the ecommerce functionality you need to sell with ease.

With a free shopping cart, you can add your products, share links, or create buy buttons even if you don’t yet have an online store. But if you do already have one, you’re not out of luck either. Merchant One seamlessly connects with 175 shopping carts and ecommerce platforms, making it easy to pair it with an existing website.

However, the company provides more than just payment processing for ecommerce—you can:

- Build customer loyalty with rewards programs

- Enable gift card purchases

- Allow shoppers to checkout faster with saved payment options

- Set up recurring billing for subscriptions

- Create, send, and manage professional invoices

There are tons of other features you can add to your system if needed, so it’s fully customizable to match your needs.

If you have a more complex setup, you or your developer can tap into multiple APIs and SDKs with full step-by-step tutorials (plus examples) to guide you through implementation.

Customer Support

First and foremost, Merchant One offers 24/7 customer support. Whether it’s the middle of your busy workday or late at night when questions pop into your head, friendly and knowledgeable agents are available around the clock.

No more waiting on hold or dealing with outsourced call centers. Merchant One makes sure your questions are answered promptly by experts dedicated to your success.

As a small business, you likely wear many hats and can’t dedicate your entire focus to payments. That’s why Merchant One offers all the onboarding help, hardware walkthroughs, customization assistance, integration support, and additional guidance you need.

The company truly cares about ensuring you fully understand every facet of your new system, no matter how long it takes.

Additionally, every customer gets a dedicated account manager. This single point of contact is there for you anytime a question or issue arises.

Whether you need help troubleshooting, want to understand a charge, or have ideas for optimizing your setup, your personal account manager is an email or phone call away. No automated bots or constantly changing faces—just reliable support from an expert focused on your business.

The one downside is that Merchant One currently does not offer live chat support. However, with phone and email available 24/7 and a dedicated account manager for each customer, the company provides exceptional service to its customers.

Analytics

You’ll find the analytics and reporting in Merchant One’s dashboard cover the basics when it comes to sales data and transactions.

At a glance, you can view running reports of all your transactions, including totals for sales, refunds, and recurring billings. For a new or small business, the simplicity can be a plus—the main metrics are there without feeling overwhelming.

However, the built-in reporting and analytics lack the depth and customization options you may want as your business grows.

The good news is that you’ll get a more advanced analytics if you use Clover’s hardware, including Station, Mini, Go, and Flex.

Clover’s customizable dashboards and real-time data make it easy to view key metrics or create detailed, specialized reports. You can also filter your data however you’d like, which makes digging deeper into your numbers a breeze. Whether creating financial reports or analyzing sales trends and opportunities, the dashboard offers detailed insights while also being straightforward to use.

Ease of Use

Merchant One’s entire business is built around simplifying payment processing and merchant services—everything about the system is designed around ease of use. Customers consistently say it’s straightforward to use on a daily basis.

More importantly, it won’t disrupt your workflows or get in the way of serving your customers.

Getting started is quick and easy too. You don’t have to jump through hoops or fill out pages of paperwork. Just call or submit a simple online form.

From there, the team will contact you to activate your account, usually within 24 hours.

Merchant One also provides unlimited training and support to make sure you know how to use the system. The company’s integration experts work with you one-on-one to connect Merchant One with your other business solutions. With the right training and integration, you can leverage Merchant One’s capabilities to its full potential.

Overall, Merchant One removes the headaches and hassles from payment processing. The easy-to-use system is perfect for busy small and new business owners.

Final Thoughts

Overall, Merchant One’s simplified approach to payment processing and merchant services is a breath of fresh air, especially if you’ve never accepted payments as a business before. With a superb customer support team, a dedicated account manager, top-notch mobile options, and affordable monthly fees, it’s a great choice for businesses that want to get started without the headache.

Advertising Disclosure

MerchantServices.org provides its users with information regarding specific merchant services and payment processing providers. We’re able to offer this information for free by entering into paid partnerships with some of the companies we review, meaning that we may receive compensation from the companies you see across our site.

This advertiser compensation paired with our formulaic ranking system and in-house conversion data influences the ratings, rankings, and placement of providers on our home page, in comparison tables, individual reviews, comparison posts, and any other types of content you find on our site.

While our goal is to provide fair, accurate, and honest reviews, we make no guarantees about the accuracy of our content.

See How We Rate Merchant Services Providers and Terms of Use for more information.